Shipping to Asia

According to the Illinois Soybean Association (ISA), Asian countries, led by Indonesia are relying on shipping containers to transport the soybeans which they have purchased. This method of transport has increased by over 40% since 2015 to 2.8 million metric tonnes. Soybeans shipped in containers to Asia are also expected to rise by around 18%, therefore making it 3.3 million metric tonnes.

This method of shipping has made it easier for smaller countries to buy U.S soybeans. It minimises their inventory investment as well as other benefits such as quality prevention and shorter delivery times without going through the main shipping channel. This also has benefits for the U.S as it means idle sitting containers can then be used to ship the soybeans, henceforth, freeing up space in their shipping yards.

Price for week 16

Due to Easter holidays, trading ended a day earlier this week. At the start of the week, soybean started trading at 898.6 cents. 2 days later however, it had plummeted to 879.0 cents. By the close of trading this week it ended up at 879.0 cents, 19,6 cents down from the previous week.

Sources:

https://www.ilsoy.org/press-release/asia-shows-increasing-demand-container-shipping-us-soybeans

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_quotes_globex.html?optid=320

Monday, April 22, 2019

Sunday, April 14, 2019

Week 15 - Argentina and Brazil raise soybean harvest estimates

Weekly Price update

Soybean May 19 futures contract has not had the best of weeks. The price settled at 895.2 cents, down by 7.2 cents from open on Sunday 7th April. There has been largely bad weather in the US Mid-West with snowstorms limiting the movements of crops. Although analysts have mentioned that although this weather may not be good for soybeans, it may benefit other grains such as wheat. Currently farmers are struggling to make a decent profit on crops as they have too much old stock and a decrease of demand from China is making it harder to move the stock.

Harvest estimates for Argentina and Brazil

Over the past week, both Argentina and Brazil has it's forecast for the harvest of soybean. The Buenos Aires Grains Exchange raised its estimates to 55 million tonnes, a day after the Rosario exchange increased its estimate for the crop. This may affect trade in the U.S as it is generally slightly cheaper to buy from Argentina and Brazil that the U.S, meaning the U.S will have to hope to be rid of the tariffs between them and China.

Sources:

https://www.cnbc.com/2019/04/12/reuters-america-grains-corn-and-soybeans-set-for-weekly-drop-on-slow-exports-and-big-latam-crops.html

CME - https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_quotes_globex.html

Soybean May 19 futures contract has not had the best of weeks. The price settled at 895.2 cents, down by 7.2 cents from open on Sunday 7th April. There has been largely bad weather in the US Mid-West with snowstorms limiting the movements of crops. Although analysts have mentioned that although this weather may not be good for soybeans, it may benefit other grains such as wheat. Currently farmers are struggling to make a decent profit on crops as they have too much old stock and a decrease of demand from China is making it harder to move the stock.

Harvest estimates for Argentina and Brazil

Over the past week, both Argentina and Brazil has it's forecast for the harvest of soybean. The Buenos Aires Grains Exchange raised its estimates to 55 million tonnes, a day after the Rosario exchange increased its estimate for the crop. This may affect trade in the U.S as it is generally slightly cheaper to buy from Argentina and Brazil that the U.S, meaning the U.S will have to hope to be rid of the tariffs between them and China.

Sources:

https://www.cnbc.com/2019/04/12/reuters-america-grains-corn-and-soybeans-set-for-weekly-drop-on-slow-exports-and-big-latam-crops.html

CME - https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_quotes_globex.html

Sunday, April 7, 2019

Week 14 - U.S. Soybean Futures Rise

U.S. soybean futures rise over 1% weekly due to trade talks optimism and USDA report.

Chicago Board of Trade (CBOT) crop futures traded higher in the trading week ending on April 5, with soybeans adding over 1 percent, as the oil seeds were boosted by optimism over trade talks between the United States and China and also USDA report. May soybeans were up 14,75 cents, or 1,67 percent, to settle at 8,99 dollar per bushel.

China and the United States concluded in Washington the ninth round of high-level economic and trade talks which ran from Wednesday to Friday. China has been the world's top soybean buyer. Any positive development concerning the trade talks between the two sides will boost U.S. soybean prices. Also, in other news, the USDA projects soybean imports at 4 million tonnes in 2019-20, up from 3,5 million tonnes in 2018-19. Most of the imports will come from the United States, according to the USDA.

These optimistic news from both sides surge soybean price a little bit and ended up having a nice day. The bull spreads are working and once announcement of a trade deal between the U.S./China, then we could see the funds start to buy back some of their huge short position in soybeans. But at the moment, it will take a miracle to rally soybeans above $9,10 against May futures because there is still have huge supplies hence, the market will be reluctant to rally too much.

Now, as trade talk is almost at the final stage, should most Farmers Hedge now or consumers should rather buy now? Well, all things being equal, we may recommend consumers to buy now because it look like something positive will come out of the Trade Talk which will soar prices.

Sources:

https://www.world-grain.com/articles/11890-egypt-soybean-imports-surging

http://www.xinhuanet.com/english/2019-04/07/c_137956011.htm

Chicago Board of Trade (CBOT) crop futures traded higher in the trading week ending on April 5, with soybeans adding over 1 percent, as the oil seeds were boosted by optimism over trade talks between the United States and China and also USDA report. May soybeans were up 14,75 cents, or 1,67 percent, to settle at 8,99 dollar per bushel.

China and the United States concluded in Washington the ninth round of high-level economic and trade talks which ran from Wednesday to Friday. China has been the world's top soybean buyer. Any positive development concerning the trade talks between the two sides will boost U.S. soybean prices. Also, in other news, the USDA projects soybean imports at 4 million tonnes in 2019-20, up from 3,5 million tonnes in 2018-19. Most of the imports will come from the United States, according to the USDA.

These optimistic news from both sides surge soybean price a little bit and ended up having a nice day. The bull spreads are working and once announcement of a trade deal between the U.S./China, then we could see the funds start to buy back some of their huge short position in soybeans. But at the moment, it will take a miracle to rally soybeans above $9,10 against May futures because there is still have huge supplies hence, the market will be reluctant to rally too much.

Now, as trade talk is almost at the final stage, should most Farmers Hedge now or consumers should rather buy now? Well, all things being equal, we may recommend consumers to buy now because it look like something positive will come out of the Trade Talk which will soar prices.

Sources:

https://www.world-grain.com/articles/11890-egypt-soybean-imports-surging

http://www.xinhuanet.com/english/2019-04/07/c_137956011.htm

Sunday, March 31, 2019

Week 13 - Soybean Stocks Hit Record High

Soybean Stocks Hit Record High

The U.S. has the most soybeans in storage according to the USDA. Farmers in the U.S. are expected to plant more corn and fewer soybeans than expected. As a result, the CME Group farm markets have reacted negatively to the USDA reports on Friday. May soybean futures ended at $8.84. July soybean futures closed at $8.97. May soymeal futures closed unchanged at $306.50. May soy oil futures closed at 28.36 per pound.

It is obvious price have declined compared to last week. Again, it is surprising to see price decline because the Data from USDA indicated farmers will plant fewer soybean, therefore this information should be a positive foundamental to increase prices on CME but the vice versa happened.

The flip side the situation is, there is high stock of soybean in storage (supply) which outweigh demand thereby dragging prices down. But then, once all the surplus soybean in storage are sold, the USDA Data about fewer soybean plantation in the future will serve as a long term price driver to surge prices.

Sources:

https://www.agriculture.com/us-soybean-stocks-hit-record-high-usda-data-drops-markets

The U.S. has the most soybeans in storage according to the USDA. Farmers in the U.S. are expected to plant more corn and fewer soybeans than expected. As a result, the CME Group farm markets have reacted negatively to the USDA reports on Friday. May soybean futures ended at $8.84. July soybean futures closed at $8.97. May soymeal futures closed unchanged at $306.50. May soy oil futures closed at 28.36 per pound.

It is obvious price have declined compared to last week. Again, it is surprising to see price decline because the Data from USDA indicated farmers will plant fewer soybean, therefore this information should be a positive foundamental to increase prices on CME but the vice versa happened.

The flip side the situation is, there is high stock of soybean in storage (supply) which outweigh demand thereby dragging prices down. But then, once all the surplus soybean in storage are sold, the USDA Data about fewer soybean plantation in the future will serve as a long term price driver to surge prices.

Sources:

https://www.agriculture.com/us-soybean-stocks-hit-record-high-usda-data-drops-markets

Sunday, March 24, 2019

Week 12 - Farmers and Soybean deals

Farmers are Stalling Soybean Deals

The rains and twists and turns in a bitter trade war between the United States and China have hurt prices. The United States and China, the world’s top soybean producer and importer respectively, have slapped import tariffs on hundreds of billions of dollars worth of each other’s products in their dispute. Tariffs made U.S. soybeans too expensive so Beijing stopped buying them, resulting in a glut that has hit soybean contracts in Chicago, the reference price for the global trade.

The uncertainty over prices and the delays to deals has also rattle the global trade as major buyers look to lock in supply but farmers are stalling deals till the conflict is over. President Trump said on Wednesday that a trade deal with Beijing was coming along nicely and have also given $12 billion aid to farmer in the US. Although this may look like a positive signal, but some “Farmers are saying ‘I don’t like the price and I don’t need the money now because I was able to make cash with wheat and corn. So I’ll wait’.”

It is obvious U.S.-China trade war determining Chicago reference prices, rather than supply and demand, which means prices are flying without instruments. Benchmark Chicago Board of Trade soybean futures are hovering around $9 per bushel throughout the week. The chart below depicts the price over the week.

Figure:

U.S officials will travel to Beijing next week for another round of negotiation. Currently, investors and farmers finds themselves in a position to make big decisions in terms of next year’s planting and hedging investment positions. But the question here is; "should farmers hedge now or wait till the end of Trade negotiation?"

Sources:

https://edition.cnn.com/2019/03/20/politics/soybean-farmers-trump-trade-war/index.html

https://www.reuters.com/article/us-argentina-soybeans-tradewar/as-bumper-harvest-nears-argentinas-soy-farmers-stall-deals-waiting-for-trade-wars-end-idUSKCN1R12MD

The rains and twists and turns in a bitter trade war between the United States and China have hurt prices. The United States and China, the world’s top soybean producer and importer respectively, have slapped import tariffs on hundreds of billions of dollars worth of each other’s products in their dispute. Tariffs made U.S. soybeans too expensive so Beijing stopped buying them, resulting in a glut that has hit soybean contracts in Chicago, the reference price for the global trade.

The uncertainty over prices and the delays to deals has also rattle the global trade as major buyers look to lock in supply but farmers are stalling deals till the conflict is over. President Trump said on Wednesday that a trade deal with Beijing was coming along nicely and have also given $12 billion aid to farmer in the US. Although this may look like a positive signal, but some “Farmers are saying ‘I don’t like the price and I don’t need the money now because I was able to make cash with wheat and corn. So I’ll wait’.”

It is obvious U.S.-China trade war determining Chicago reference prices, rather than supply and demand, which means prices are flying without instruments. Benchmark Chicago Board of Trade soybean futures are hovering around $9 per bushel throughout the week. The chart below depicts the price over the week.

Figure:

U.S officials will travel to Beijing next week for another round of negotiation. Currently, investors and farmers finds themselves in a position to make big decisions in terms of next year’s planting and hedging investment positions. But the question here is; "should farmers hedge now or wait till the end of Trade negotiation?"

Sources:

https://edition.cnn.com/2019/03/20/politics/soybean-farmers-trump-trade-war/index.html

https://www.reuters.com/article/us-argentina-soybeans-tradewar/as-bumper-harvest-nears-argentinas-soy-farmers-stall-deals-waiting-for-trade-wars-end-idUSKCN1R12MD

Sunday, March 17, 2019

Week 11 - An update on the US v China trade war

Trade war update

As many of you know, and as previously mentioned in a past post, China and the US are in the middle of a trade war which has affected the demand of US soybeans dramatically. It has led to an increase in demand for soybeans from Brazil, but this could all be coming to an end. According to Reuters, and the US Trade Representative Robert Lightizer, "....negotiations are entering their final weeks on a possible accord, that could see China remove a 25 percent tariff on U.S. soy that upended global farm trade and shifted demand toward Brazil."

As this war between the countries progressed, China has had to rely on Brazil for the demand for soybeans to replace what they was importing from the U.S. In 2017/18, Brazil had a record-high production crop year that meant China did not have to rely to heavily on the United States. However, this year the output is expected to be lower and will Brazil would not be able to supply what is needed, and therefore, China will to be relying on the US again. Hence a need for the trade war (especially on soybeans) to be resolved.

Price update over the past week

In week 11, the price for soybean futures May 2019 contract opened at 898.2 cents, and closed at the end of the first day of trading at 890. With the price being at its lowest since January, the news of the US v China trade potentially coming to end caused the price of soybeans to increase throughout the week, with a slight blip on the 14th March where price decreased from the previous day. At the close of trading on Friday, the price had a 1.20% increase from its previous day and closed at 909.2.

Soybean meal followed the same sort of trend and increased throughout the week. On the close of trading on Monday, the price was at 301.3 cents, down from the close on Friday by 0.79%. From then, the price increased throughout the week and closed on 310.8, an increase of 9.5 overall. In comparison, soybean oil continued its trend of backwardation with the previous week. At close on Monday, price was at 29.64 cents, and apart from an increase on Tuesday, the price in general continued to fall and on Friday, closed at 29.43 cents.

As the season for growing soybeans is approaching, we may potentially see the 3 soybeans price begin to rise steadily. However, depending on the weather this year, growth could exceed last year or decrease which could pose for an interesting year.

Sources

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean-oil_quotes_globex.html

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_quotes_globex.html

https://www.reuters.com/article/usa-trade-china-brazil/brazil-preparing-for-end-of-u-s-china-trade-war-mulls-response-officials-idUSL1N20Z24N

As many of you know, and as previously mentioned in a past post, China and the US are in the middle of a trade war which has affected the demand of US soybeans dramatically. It has led to an increase in demand for soybeans from Brazil, but this could all be coming to an end. According to Reuters, and the US Trade Representative Robert Lightizer, "....negotiations are entering their final weeks on a possible accord, that could see China remove a 25 percent tariff on U.S. soy that upended global farm trade and shifted demand toward Brazil."

As this war between the countries progressed, China has had to rely on Brazil for the demand for soybeans to replace what they was importing from the U.S. In 2017/18, Brazil had a record-high production crop year that meant China did not have to rely to heavily on the United States. However, this year the output is expected to be lower and will Brazil would not be able to supply what is needed, and therefore, China will to be relying on the US again. Hence a need for the trade war (especially on soybeans) to be resolved.

Price update over the past week

In week 11, the price for soybean futures May 2019 contract opened at 898.2 cents, and closed at the end of the first day of trading at 890. With the price being at its lowest since January, the news of the US v China trade potentially coming to end caused the price of soybeans to increase throughout the week, with a slight blip on the 14th March where price decreased from the previous day. At the close of trading on Friday, the price had a 1.20% increase from its previous day and closed at 909.2.

Soybean meal followed the same sort of trend and increased throughout the week. On the close of trading on Monday, the price was at 301.3 cents, down from the close on Friday by 0.79%. From then, the price increased throughout the week and closed on 310.8, an increase of 9.5 overall. In comparison, soybean oil continued its trend of backwardation with the previous week. At close on Monday, price was at 29.64 cents, and apart from an increase on Tuesday, the price in general continued to fall and on Friday, closed at 29.43 cents.

As the season for growing soybeans is approaching, we may potentially see the 3 soybeans price begin to rise steadily. However, depending on the weather this year, growth could exceed last year or decrease which could pose for an interesting year.

Sources

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean-oil_quotes_globex.html

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_quotes_globex.html

https://www.reuters.com/article/usa-trade-china-brazil/brazil-preparing-for-end-of-u-s-china-trade-war-mulls-response-officials-idUSL1N20Z24N

Sunday, March 10, 2019

Week 10 - The Crush Spread

THE CRUSH SPREAD

Crush spreads most often gives good signal of the futures price trend of a commodity. The crush is quoted as the difference between the combined sales value of soybean meal and oil and the price of soybeans. When a commodity is the product of refining another raw commodity, the refining spread between two commodities often indicates the direction of demand and supply.

At the start of this week, March contract for Monday (4th March, 2019), the crush spread for turning soybeans into meal and oil was at around 98 cents per bushel and at the end of the week the crush spread was at the 96 cents per bushel. This tells us a lot about the demand for soybeans and soybean products that trade on the CME. First, it tells us that a bumper crop increased inventories of both soybeans and soybean products, thus, causing prices to fall. Second, it tells us that the economics of processing soybeans into soybean products deteriorated over the week. Lastly, since the price difference is very narrow, the narrow spread occurs when the price of Soybean futures rises relative to the combined sales price of Soybean Oil and Meal futures. When this occurs, the spread declines. This means that, if traders anticipate same narrow crush spread for the coming week, they will buy Soybean futures and sell Soybean Meal and Soybean Oil futures.

Even though the price of the overall crush spread fell, processing raw soybeans into soybean oil was profitable on its own while meal processing was not. China, a huge consumer of soybean oil given the nation's massive population supported the price of soybean oil as they consumed and built inventories of the soybean product for the future.

SOURCES

https://www.cmegroup.com/education/courses/introduction-to-agriculture/grains-oilseeds/understanding-soybean-crush.html

Crush spreads most often gives good signal of the futures price trend of a commodity. The crush is quoted as the difference between the combined sales value of soybean meal and oil and the price of soybeans. When a commodity is the product of refining another raw commodity, the refining spread between two commodities often indicates the direction of demand and supply.

At the start of this week, March contract for Monday (4th March, 2019), the crush spread for turning soybeans into meal and oil was at around 98 cents per bushel and at the end of the week the crush spread was at the 96 cents per bushel. This tells us a lot about the demand for soybeans and soybean products that trade on the CME. First, it tells us that a bumper crop increased inventories of both soybeans and soybean products, thus, causing prices to fall. Second, it tells us that the economics of processing soybeans into soybean products deteriorated over the week. Lastly, since the price difference is very narrow, the narrow spread occurs when the price of Soybean futures rises relative to the combined sales price of Soybean Oil and Meal futures. When this occurs, the spread declines. This means that, if traders anticipate same narrow crush spread for the coming week, they will buy Soybean futures and sell Soybean Meal and Soybean Oil futures.

Even though the price of the overall crush spread fell, processing raw soybeans into soybean oil was profitable on its own while meal processing was not. China, a huge consumer of soybean oil given the nation's massive population supported the price of soybean oil as they consumed and built inventories of the soybean product for the future.

SOURCES

https://www.cmegroup.com/education/courses/introduction-to-agriculture/grains-oilseeds/understanding-soybean-crush.html

Sunday, March 3, 2019

Week 9 - The making of Soybean meal and oil

A brief overview of Soybean Meal and Oil

The majority of Soybean crops are divided between soybean meal and oil. Soybean meal is mainly used as a high protein diet for animals. Soybean oil is used for vegetable oil, and in the US, it is the main oil-seed used, accounting for around 90% of all oil-seed production. Soybean as a whole is the second most traded agricultural commodity. Soybean meal futures contract has 8 contract months and Soybean oil also has 8 contracts that are trade-able.

What influences the price?

Growing conditions, like other agricultural commodities are affected by the weather conditions during growing season. If the conditions are too wet, then production will be affected. As the US is the biggest producers of Soybean, the strength of US dollar affects prices. A weak dollar can ultimately affect production as farmers may not want to producer as much, knowing that they will not get the same or better price than the previous year.

The Chinese demand for Soybean, especially "meal" has a huge impact on prices. The Chinese demand for the protein feed accounts for around 2/3rds of the worlds feed. China is a price driver of Soybean and they are able to affect the market significantly due to being the largest importers.

Weekly Soybean/meal/oil Price for the March 2019 futures contract

Below is an overview of how the prices fluctuated for March 2019 futures contract for week 9. As you can see, Soybean and soybean meal have a relatively similar chart, such as that when Soybean prices decreased, Soybean meal generally decreased too. However, Soybean oil has a slightly different trend and decreased more often in comparison to the other two.

Future blogs will expand on how Soybean prices influences both Soybean meal and oil prices. Along with that, we will also provide updates on how the China vs US trade war is improving (or not).

Sources

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_contract_specifications.html

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean-oil_contract_specifications.html

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean-meal_quotes_globex.html

The majority of Soybean crops are divided between soybean meal and oil. Soybean meal is mainly used as a high protein diet for animals. Soybean oil is used for vegetable oil, and in the US, it is the main oil-seed used, accounting for around 90% of all oil-seed production. Soybean as a whole is the second most traded agricultural commodity. Soybean meal futures contract has 8 contract months and Soybean oil also has 8 contracts that are trade-able.

What influences the price?

Growing conditions, like other agricultural commodities are affected by the weather conditions during growing season. If the conditions are too wet, then production will be affected. As the US is the biggest producers of Soybean, the strength of US dollar affects prices. A weak dollar can ultimately affect production as farmers may not want to producer as much, knowing that they will not get the same or better price than the previous year.

The Chinese demand for Soybean, especially "meal" has a huge impact on prices. The Chinese demand for the protein feed accounts for around 2/3rds of the worlds feed. China is a price driver of Soybean and they are able to affect the market significantly due to being the largest importers.

Weekly Soybean/meal/oil Price for the March 2019 futures contract

Below is an overview of how the prices fluctuated for March 2019 futures contract for week 9. As you can see, Soybean and soybean meal have a relatively similar chart, such as that when Soybean prices decreased, Soybean meal generally decreased too. However, Soybean oil has a slightly different trend and decreased more often in comparison to the other two.

Future blogs will expand on how Soybean prices influences both Soybean meal and oil prices. Along with that, we will also provide updates on how the China vs US trade war is improving (or not).

Sources

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_contract_specifications.html

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean-oil_contract_specifications.html

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean-meal_quotes_globex.html

Sunday, February 24, 2019

Week 8 - activities on Soybean

Soybean set out to close the week with minor gains after continuous plummet last week juiced by pessimism over the U.S.-China trade negotiations (Bloomberg). As a result, supply outnumbered demand forcing the price to a continuous decline. But now, the gains are also coming because China had agreed to buy an additional 10 million metric tons of soybeans. On the other hand, part of the report says China has long term plans to expand soybean crop and farm subsidies to cut reliance on US imports (South China Morning Post). This information has created so much uncertainty in the market.

Prior to the US/China trade negotiation, Soybeans price for March 2019 Futures contract was 902,40 USd and 109,003 volume of trades. Right after the negotiation, the market found confidence in the commodity and price surged to 911,00 USd, 146,573 volume of trades and settled 910,25 USd on Friday. The chart below depict the weekly swings in the price of Soybean March 2019 Futures Contract.

Although there is unclear trend in the market, in our best of knowledge we hope the outcome of the negotiation will attract new investors in the market and release pressure on sellers who were in the market last week to sell their crop before the negotiation goes bad. Hence, price may go up a little bit in the coming week.

References:

1. https://www.bloomberg.com/news/articles/2019-02-23/china-s-pledge-for-u-s-soy-buying-catches-traders-off-guard

2. https://amp.scmp.com/news/china/diplomacy/article/2187088/china-increases-land-soybean-crop-and-subsidies-farmers-effort

3. https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_quotes_settlements_futures.html#tradeDate=02%2F22%2F2019

Sunday, February 17, 2019

Week 7 - General Information and Spot Prices of Soybean

A little introduction about Soybean/meal/oil

Soybean is an edible bean that is native to East Asia, however, it is widely grown and distributed from the United States and Brazil. There are 150 different types of soybean, although the most common is the yellow bean, with 2/3 of soybean processed into soybean oil or meal. Soybean meal is mainly used as a source of protein for livestock, but can also be used for human foods such as Soy-milk, flour and tofu. Soybean oil is used for cooking and is the most used oil in the US. Soybean is also one the most traded agriculture commodities where its main trading location is at the Chicago Mercantile Exchange (CME).

Exporters/importers of Soybean

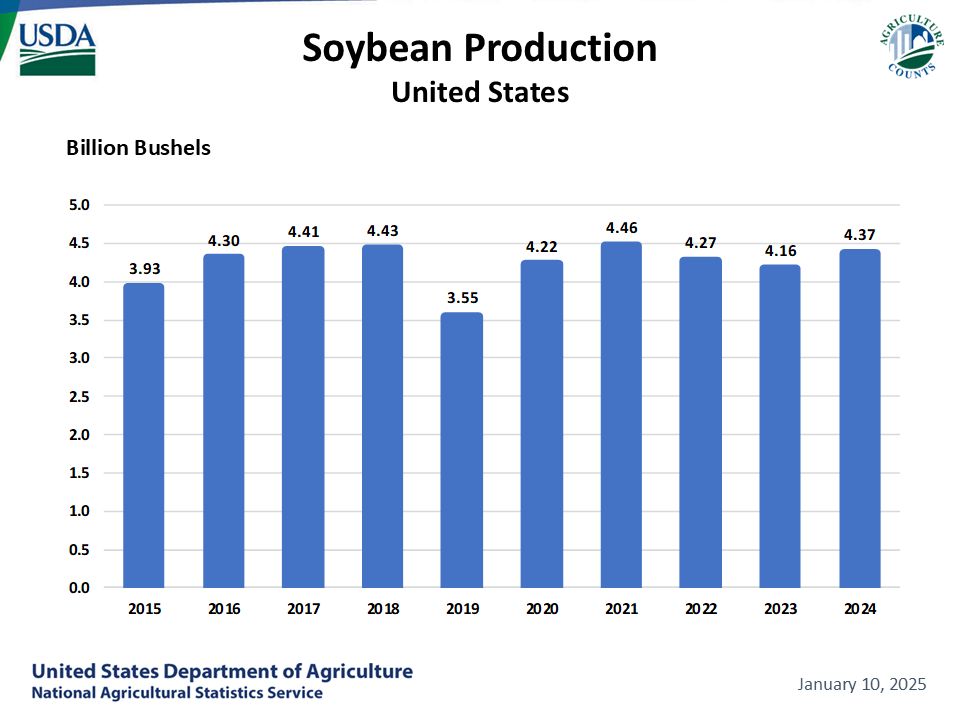

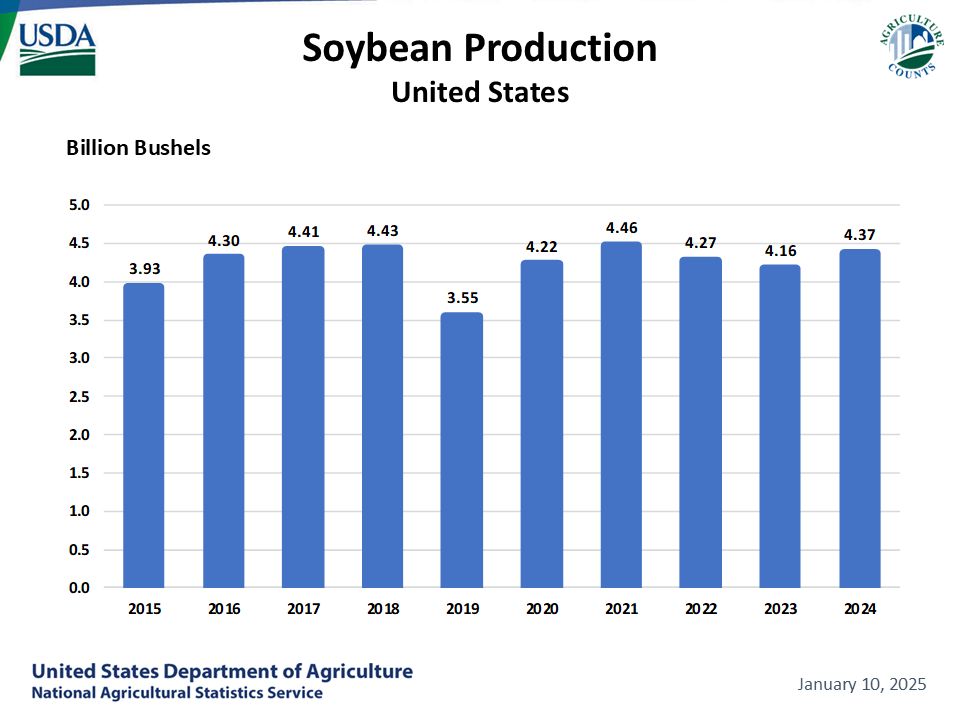

The US and Brazil are the largest producers of soybean with the US producing over 100 million metric tons and Brazil over 80 million metric tons. On the other hand, Brazil were the largest exports of soybean, exporting over 70 million metric tons worldwide with the US exporting just over half of their production (as of 2018). The biggest importers of soybean were China, importing over $30billion worth throughout the year. The EU-27 imported a mere fraction of China standing at 15 million metric tons. The above graph shows soybean production in the United States since 1998 and as you can see, it has steadily grown (albeit with some minor decreases).

China vs US trade war on Soybeans

As many will know, there is a huge war in action, the China vs US trade war. Both countries have put high tariffs worth billions of dollars on each others good. When it comes to soybeans however, it will affect the US more than it will China as they plan to cut the percentage of rations for hogs from 20% to 12% (27 million metric tons). This equates to over 80% of soybean imports from the US, meaning this would hit the US farmers hard. If no agreement between the two countries happens, then you could see a huge impact on US farmers not being able to sell their crops.

As many will know, there is a huge war in action, the China vs US trade war. Both countries have put high tariffs worth billions of dollars on each others good. When it comes to soybeans however, it will affect the US more than it will China as they plan to cut the percentage of rations for hogs from 20% to 12% (27 million metric tons). This equates to over 80% of soybean imports from the US, meaning this would hit the US farmers hard. If no agreement between the two countries happens, then you could see a huge impact on US farmers not being able to sell their crops.

Soybean spot price fluctuations over the last 7 days

The chart shows how the spot price of soybean has been over the last few days (week 7). As you can see, the price started at around $9.15 per contract (5000 bushels) and had a decrease of over 10 cents over the next day. Between the 12th and 13th (February) it had a high increase towards the end of day trading and was over $9.15. This remained steady over the next couple of days before decreasing again to finish weekly trading 0.77% down at $9.14

Sources

Graph from USDA (United States department of Agriculture

https://www.nass.usda.gov/Charts_and_Maps/Field_Crops/soyprod.php

Reuters - Inside Chinas Strategy in the Soybean Trade War

https://www.reuters.com/article/uk-usa-trade-china-soymeal-insight/inside-chinas-strategy-in-the-soybean-trade-war-idUSKCN1OQ0D2

Graph 2 - Soybeans price

https://markets.businessinsider.com/commodities/soybeans-price/usd

CME - Soybean

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_contract_specifications.html

Picture - China Vs US

https://www.google.com/search?rlz=1C1CHBD_en-GBGB781GB782&biw=1536&bih=732&tbm=isch&sa=1&ei=TltoXO_iK8yFk74P-YeUwAY&q=China+vs+Us+trade+war+soybean&oq=China+vs+Us+trade+war+soybean&gs_l=img.3...3353.5391..5577...0.0..0.84.519.8......1....1..gws-wiz-img.......0i30j0i24.mZ5cZ7xlo8g#imgrc=fCSLhtfMVk93IM:

Soybean is an edible bean that is native to East Asia, however, it is widely grown and distributed from the United States and Brazil. There are 150 different types of soybean, although the most common is the yellow bean, with 2/3 of soybean processed into soybean oil or meal. Soybean meal is mainly used as a source of protein for livestock, but can also be used for human foods such as Soy-milk, flour and tofu. Soybean oil is used for cooking and is the most used oil in the US. Soybean is also one the most traded agriculture commodities where its main trading location is at the Chicago Mercantile Exchange (CME).

Exporters/importers of Soybean

The US and Brazil are the largest producers of soybean with the US producing over 100 million metric tons and Brazil over 80 million metric tons. On the other hand, Brazil were the largest exports of soybean, exporting over 70 million metric tons worldwide with the US exporting just over half of their production (as of 2018). The biggest importers of soybean were China, importing over $30billion worth throughout the year. The EU-27 imported a mere fraction of China standing at 15 million metric tons. The above graph shows soybean production in the United States since 1998 and as you can see, it has steadily grown (albeit with some minor decreases).

China vs US trade war on Soybeans

As many will know, there is a huge war in action, the China vs US trade war. Both countries have put high tariffs worth billions of dollars on each others good. When it comes to soybeans however, it will affect the US more than it will China as they plan to cut the percentage of rations for hogs from 20% to 12% (27 million metric tons). This equates to over 80% of soybean imports from the US, meaning this would hit the US farmers hard. If no agreement between the two countries happens, then you could see a huge impact on US farmers not being able to sell their crops.

As many will know, there is a huge war in action, the China vs US trade war. Both countries have put high tariffs worth billions of dollars on each others good. When it comes to soybeans however, it will affect the US more than it will China as they plan to cut the percentage of rations for hogs from 20% to 12% (27 million metric tons). This equates to over 80% of soybean imports from the US, meaning this would hit the US farmers hard. If no agreement between the two countries happens, then you could see a huge impact on US farmers not being able to sell their crops.Soybean spot price fluctuations over the last 7 days

The chart shows how the spot price of soybean has been over the last few days (week 7). As you can see, the price started at around $9.15 per contract (5000 bushels) and had a decrease of over 10 cents over the next day. Between the 12th and 13th (February) it had a high increase towards the end of day trading and was over $9.15. This remained steady over the next couple of days before decreasing again to finish weekly trading 0.77% down at $9.14

Sources

Graph from USDA (United States department of Agriculture

https://www.nass.usda.gov/Charts_and_Maps/Field_Crops/soyprod.php

Reuters - Inside Chinas Strategy in the Soybean Trade War

https://www.reuters.com/article/uk-usa-trade-china-soymeal-insight/inside-chinas-strategy-in-the-soybean-trade-war-idUSKCN1OQ0D2

Graph 2 - Soybeans price

https://markets.businessinsider.com/commodities/soybeans-price/usd

CME - Soybean

https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_contract_specifications.html

Picture - China Vs US

https://www.google.com/search?rlz=1C1CHBD_en-GBGB781GB782&biw=1536&bih=732&tbm=isch&sa=1&ei=TltoXO_iK8yFk74P-YeUwAY&q=China+vs+Us+trade+war+soybean&oq=China+vs+Us+trade+war+soybean&gs_l=img.3...3353.5391..5577...0.0..0.84.519.8......1....1..gws-wiz-img.......0i30j0i24.mZ5cZ7xlo8g#imgrc=fCSLhtfMVk93IM:

Subscribe to:

Comments (Atom)